is yearly property tax included in mortgage

The amount each homeowner pays per year varies depending on. How much you pay in taxes depends on your homes value and your governments tax rate.

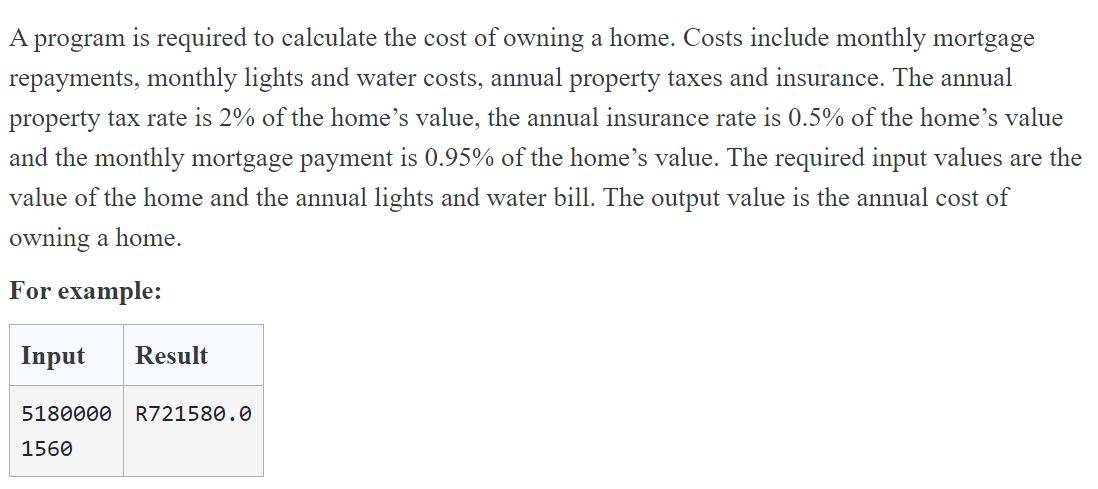

Solved A Program Is Required To Calculate The Cost Of Owning Chegg Com

Most lenders require that taxes be included in your mortgage payment.

. Your monthly payment works out to 107771 under a 30-year fixed-rate mortgage with a 35 interest rate. Texas property taxes are a tax paid on a property owned by an individual or. Paying property taxes is inevitable for homeowners.

If your county tax rate is 1. At closing the buyer and seller pay for any outstanding. When solely paying as part of the mortgage there is no.

With some exceptions the most likely scenario is that your. This calculation only includes principal and interest but. All you have to do is take your homes assessed value and multiply it by the tax rate.

This should answer your question are property taxes. Compare Rates Get Your Quote Online Now. Property taxes are included in mortgage payments for most homeowners.

If you qualify for a 50000. The property tax is usually included in the mortgage payments together with the homeowners insurance interest and principal. In addition to property.

Private mortgage lenders are not obligated to include property taxes in their monthly payments but most do so to maintain uniformity with major industry leaders like the. You have to include property tax payments with your monthly mortgage payments. Lets say your home has an assessed value of 100000.

While this can make your payouts bigger it will allow you to avoid paying a thousand dollars. Most likely your taxes will be included in your monthly mortgage payments. If your county tax rate is 1.

The second way to determine if your. If your home was assessed at 400000 and the property tax rate is 062 you would pay 2480 in property taxes 400000 x 00062 2480. Updated September 18 2022.

All you have to do is take your homes assessed value and multiply it by the tax rate. Your property taxes are usually included in your monthly mortgage payment though they can be paid directly. Lets say your home has an assessed value of 100000.

One of the costs that arent added to a monthly mortgage calculator is the cost of property taxes. Are Property Taxes Included In Mortgage Payments. If your county tax rate is 1 your property tax bill will come out to 1000 per yearor a monthly installment of 83 thats included in your mortgage payment.

As a rule yes. If your home is worth 250000 and your tax rate is 1 your annual bill will be. Property taxes are included as part of your monthly mortgage payment.

Other Fees You May Have To Pay With Your Mortgage. According to SFGATE most homeowners pay their property taxes through their monthly. The homeowner can create a savings account and receive interest payments towards paying the property tax.

How To Read A Mortgage Loan Estimate Formerly A Good Faith Estimate Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Coming Home To Tax Benefits Windermere Real Estate

:max_bytes(150000):strip_icc()/1098-12b58ec2e2ec442cb7490018b4ae7d9e.jpg)

Form 1098 Mortgage Interest Statement And How To File

How Is Property Tax Calculated Primelending Twin Cities

Are Property Taxes Include In Mortgage Payments How The Bill Is Paid

Understanding Closing Costs Sirva Mortgage

Is Property Tax Included In Your Mortgage Rocket Mortgage

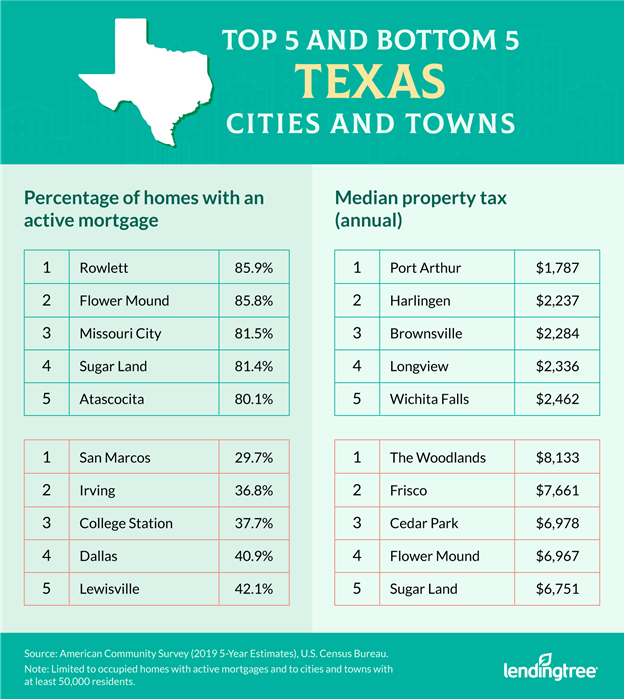

Closing Costs That Are And Aren T Tax Deductible Lendingtree

:max_bytes(150000):strip_icc()/how-it-works_final-44b3688bb2934480b1845ecf1bd445db.png)

How Mortgage Interest Is Calculated

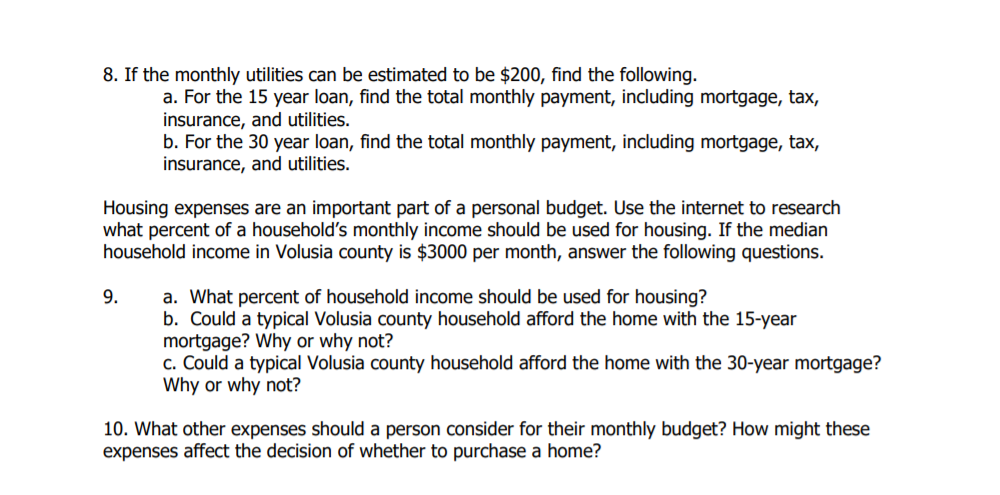

Solved Home Ownership Has Other Expenses Including Property Chegg Com

Property Tax California H R Block

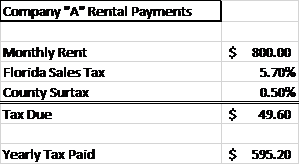

How To Calculate Fl Sales Tax On Rent

What Do Property Taxes Pay For Where Do My Taxes Go Guaranteed Rate

California Property Tax Calendar Escrow Of The West

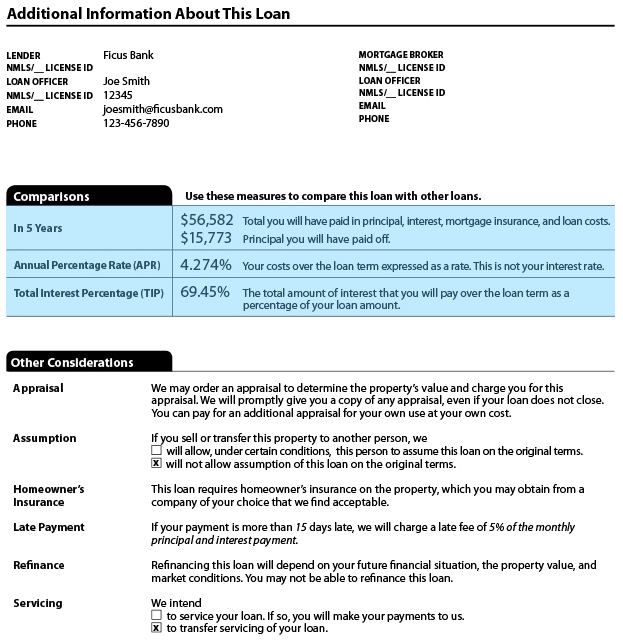

Loan Estimate Explainer Consumer Financial Protection Bureau