indiana estimated tax payment due dates 2021

We will update this page with a new version of the form for 2023 as soon as it is made available by the Indiana government. 18 2022 Mail entire form and payment to.

Use this form to make an estimated tax payment.

. 18 2022 Mail entire form and payment to. 15 2021 4th payment. These tax types will move to INTIME in July 2022.

The Treasury Department and Internal Revenue Service announced on March 17 that the federal income tax filing and payment due date for individuals for the 2020 tax year will be automatically extended from April 15 2021 to May 17 2021. 15 2022 and Jan. Option 1 Pay all your estimated tax by Jan.

Box 6102 Indianapolis IN 46206-6102 Form ES-40 State Form 46005 R19 9-20 Spouses Social Security Number. Make joint estimated tax payments. 1st Installment payment due April 15 2021 2nd Installment payment due June 15 2021 3rd Installment payment due Sept.

For more information on Rollout 4 visit Project NextDOR at wwwingovdorproject-nextdor. 14 2022 to avoid penalties. You can pay all of your estimated tax by April 15 2021 or in four equal amounts by the dates shown below.

No Indiana income tax is withheld is evenly distributed during the year such as pension income then you should file Schedule IT-2210 instead. As you can see the dates will roll into the next calendar year. Payment due date for 2021 estimated tax - Jan.

Tax return then you should pay estimated tax. Payment of estimated taxes is due in installments. This estimated payment is for tax year ending december 31 2021 or for tax year ending.

15 2021 and file your Form IT-40 by April 15 2021 OR Option 2 File your Form IT-40 by March 1 2021 and pay all the tax due. If you are required to make estimated tax payments your payment for the fourth quarter of. This form is for income earned in tax year 2021 with tax returns due in April 2022.

While interest is due on any amount paid after the original April 18 2021 due date penalty will be waived if both of the following conditions are met. Due dates are mid-April June September and the January following the last month of the calendar year. The first installment payment is due April 18 2022.

Pursuant to Notice 2020-18 PDF the due date for your first estimated tax payment was automatically postponed from April 15 2020 to July 15 2020. You must file your 2021 state tax return by Nov. We suggest that first-time estimated income taxpayers make a.

15 2021 4th Installment payment due Jan. We last updated Indiana Form ES-40 in January 2022 from the Indiana Department of Revenue. 14 2022 for Indiana tax returns you must pay 90 of your 2021 income tax due by April 18 2022 and the remaining amount owed by Nov.

The remaining balance due is. To meet an exception to the underpayment penalty for 2021 you may use Option 1 or Option 2. The remaining three payments are due June 15 and Sept.

18 2022 You dont have to make the payment due January 18. IRS and Indiana DOR Extend Tax Filing Deadline to May 17 2021 March 26 2021. Due dates for the 2021 tax season are.

April 15 2021 2nd payment. 1st Installment payment due April 15 2021 nd 2 Installment payment due June 15 2021 3rd Installment payment due Sept. 15 2021 4th Installment payment due Jan.

First quarter estimated tax payments remain due on april 15th Indiana department of revenue po. June 15 2022 3rd payment. This relief does not apply to estimated tax payments that were due on.

As of September 2021. Due date is april 15 2021. Intax supports the ability to file and pay electronically for the following taxes.

Special Fuel and Permissive Suppliers first monthly estimated payment due Fuel. ST-103 ST-103CAR ST-103MP CIT-103 FAB-103 MVR-103 TF-103 WPC-103. Important 2021 Tax Due Dates for Individuals.

Monthly Trust Tax Returns for January Early Filers. Aviation Fuel Excise Tax Return. April 15 2021 1 st installment June 15 2021 2 nd installment Sept.

April 18 2022 2nd payment. If the IRS extension is granted the Indiana. Indiana Department of Revenue PO.

14 2022 and pay any balance due with that filing. If you meet the requirements for paying estimated tax every quarter payments for tax year 2022 are due every quarter on these dates. If the due date falls on a national or state holiday Saturday or Sunday payment postmarked by the day following that holiday or Sunday is considered on time.

15 2021 Mail entire form and payment to. 15 2020 4th Installment payment due Jan. Indiana Department of Revenue PO.

Pay all your estimated tax by Jan. Individuals who are not able to file by the May 17 2021 deadline can file an extension directly with DOR or with the Internal Revenue Service IRS. 2020 Extended Due Date of First Estimated Tax Payment.

Taxpayers who paid too little tax during 2021 can still avoid a surprise tax-time bill and possible penalty by making a quarterly estimated tax payment now directly to the Internal Revenue Service. Box 6102 Indianapolis IN 46206-6102 Form ES-40 State Form 46005 R19 12-19 Spouses Social Security Number. Income taxes are pay-as-you-go.

15 2021 3 rd installment Jan. 18 2022 and file your Form IT-40 by April 18 2022 OR Option 2 File your Form IT-40 by March 1 2022 and pay all the tax due. You are not required to make an estimated tax payment if you choose Indiana Department of Revenue Underpayment of Estimated Tax by Individuals.

Use the worksheet below to determine how much youll owe. March 26 2021. 15 2010 4th installment payment due jan.

These individuals can take credit only for the estimated tax payments that they made. June 15 2021 3rd payment. Box 6102 Indianapolis IN 46206-6102 Form ES-40 State Form 46005 R19 9-20 Spouses Social Security Number.

All other tax return filings and payment due dates remain unchanged. You can pay all of your estimated tax by April 18 2022 or in four equal amounts by the dates shown below. 1st Installment payment due April 15 2020 2nd Installment payment due June 15 2020 3rd Installment payment due Sept.

The deadline for making a payment for the fourth quarter of 2021 is Tuesday January 18 2022. 18 2022 4 th installment. If you indicate on your timely.

This means that taxpayers need to pay. If at least two-thirds of your income for 2020 or 2021 was from farming or fishing you have only one payment due date for 2021 estimated tax Jan. Individual tax returns and payments originally due by April 15 2021 are now due on or before May 17 2021.

Estimated payments can be made by one of the following. File Now with TurboTax. Indiana Department of Revenue PO.

First quarter 2022 estimated tax payments are due on April 18 2022.

Printable 2021 Indiana Form Es 40 Estimated Tax Payment Voucher

Prepare Efile Your Indiana State Tax Return For 2021 In 2022

Indiana State Tax Information Support

Guide And Calculator 2022 Indiana Sales Tax Taxjar

Indiana Sales Tax Small Business Guide Truic

Indiana Woman Is First Person To Be Sentenced In Capitol Riot The New York Times

Indiana Pacers On The Forbes Nba Team Valuations List

Indiana Lawmakers Approve Expanding 125 Tax Refund Eligibility Wish Tv Indianapolis News Indiana Weather Indiana Traffic

Indiana State Taxes For 2022 Tax Season Forbes Advisor

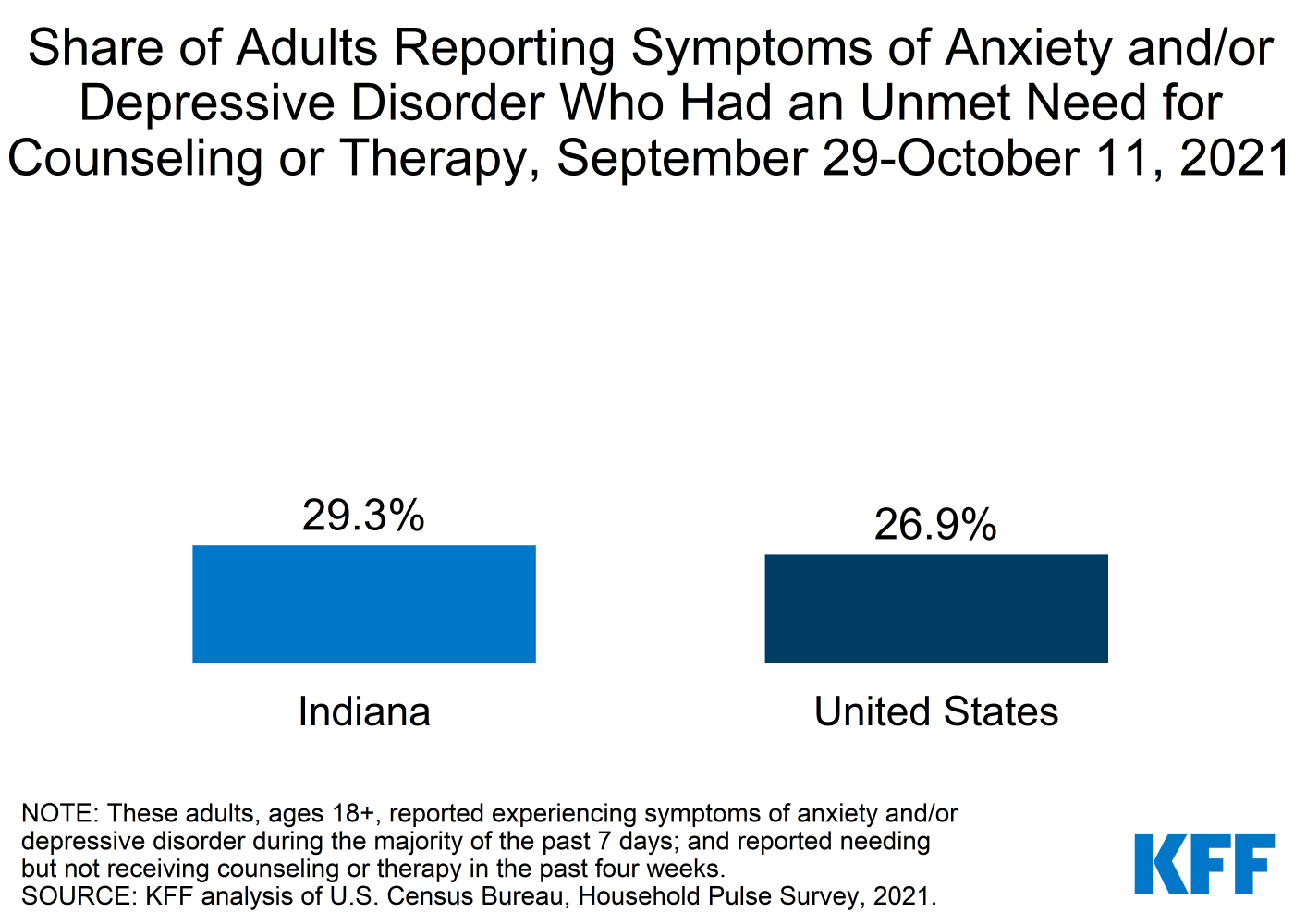

Mental Health And Substance Use State Fact Sheets Indiana Kff

Indiana State Tax Updates Withum

Drivers Trip Envelopes Pinterest For Business Employee Handbook Template Truck Driver

Indiana Income Tax Calculator Smartasset

Auto Repair Invoice For Wisconsin Automotive Repair Auto Repair Estimates Auto Repair

Large Set Of Indiana Marigold Grape Harvest Carnival Glass Etsy In 2021 Carnival Glass Vintage Carnival Glass Antique Glassware